Making sense of European energy policy

Má shíleann tú go réiteoidh an margadh é, is clasán thú!

Stewart McGill

The energy plans unfolded by the EU and British government are short-term palliative, inadequate band-aid solutions to fundamental problems that require major surgical restructuring.

Following the announcement by incoming Tory Prime Minister Liz Truss that her government will introduce a new financial support package to lower energy bills for businesses and households, last week the EU published its own proposals to do the same. Under these proposals, a windfall tax of around €140bn on energy producers will be redistributed among consumers and businesses alongside mandatory cuts to peak electricity use.

Sections of the left had previously warned that this limited intervention – absent the introduction of a price cap – would likely push energy costs for industry even higher, potentially resulting in increased prices for consumers and/or a steep drop in economic activity.

Initial reaction from industry to the EU’s plans reflect these concerns, with energy-intensive sectors such as aluminium and steel production claiming that they will do little to ease current high prices that have led to the shutdown of large portions of industry.

The measures “are unlikely to stop the current trend of production curtailments and temporary lay-offs”, says the European Steel Association. The trade body European Aluminium said Brussels’ “are not enough” to address soaring input prices or “save the aluminium industry from further production cuts, job losses and possibly a complete breakdown.”

Responding to the British government’s intervention, the Federation of Small Businesses (FSB) has predicted that this winter “could easily be just as devastating … if not worse” than the pandemic, which saw 5 percent of all SMEs (390,000 in total) going bust. These concerns have been echoed by the Irish SME Association (ISME), which has warned that the “cost of Government inaction” will be a much higher rate of business closure. Given the large numbers employed by SMEs in both countries, a widespread, catastrophic collapse would have knock-on effects in the domestic economy and on major trading partners in Europe.

Manufacturing industry bodies are reportedly massively frustrated at governments’ inability to understand the nature and the depth of the problem. They are having to explain that many manufacturing units just can’t “turn the power off for a while” as it brings complex interactive processes to a halt.

What is to be done?

Decouple electricity prices from gas

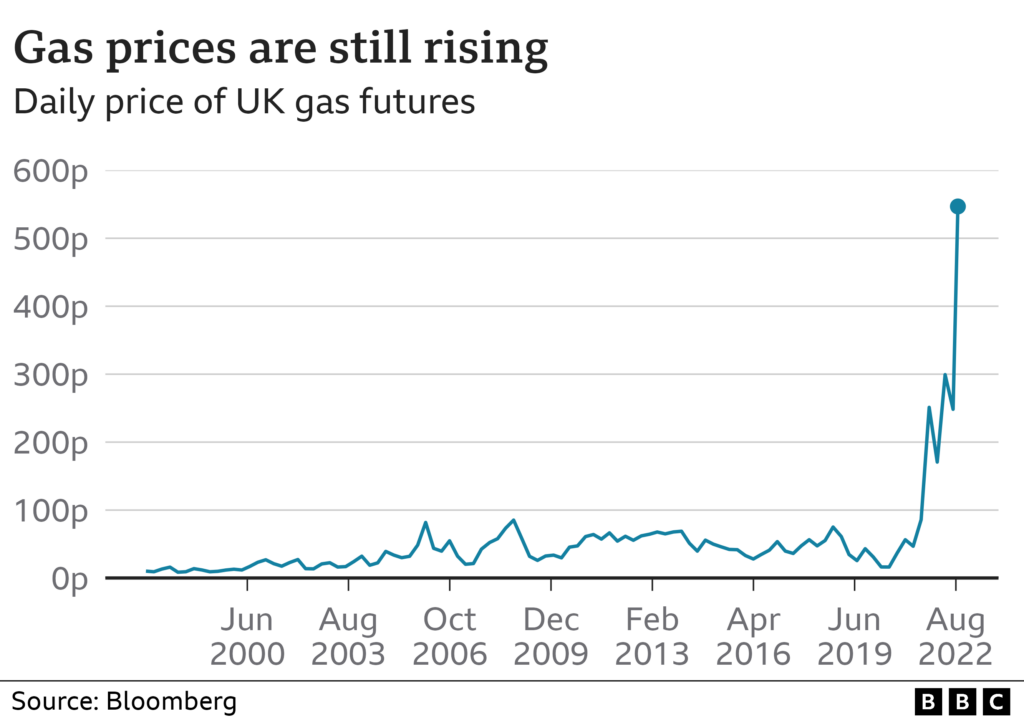

Across Europe the electricity price is determined every 30 minutes by the marginal cost of the last generating unit to be turned on to meet demand. The power grid takes what it can from wind and solar generation, with some biomass and nuclear and the last remnants of the coal-burners. However, to meet demand, because they are flexible and reliable, it then turns to gas-fired power stations; while their costs remain so high, the price they charge per unit is also high.

As a result, the electricity price is set based on the cost of running gas power which is currently hugely expensive and insecure. Think of it as a bit like a penalty shoot out: the first four may take you down to the last penalty, but it’s the last one that counts and in this case that’s the one you pay for.

A recent paper by UCL shows the full impact of this on electricity prices:

“Natural gas is the main driver of electricity prices across Europe confirms research published by UCL. Despite gas providing under half of the total electricity in the UK, in recent years it set electricity costs 84% of the time.”

Professor Michael Grubb (UCL Institute for Sustainable Resources), who is leading the research, said: “Fossil fuels used to be cheaper than renewable energy sources, but that has turned on its head as gas prices shot up and the cost to produce renewables such as wind and solar power has plummeted. Half of our electricity already comes from non-fossil fuels, and that figure is growing…

If we actually paid the average price of what our electricity now costs to produce, our bills would be substantially cheaper.”

The system was put in place partly to secure a prices and profits for renewables. Reform is well overdue, and both the EU and individual governments understand this. It’s a matter of acting quickly. As the current system also serves to guarantee good profit margins for those in the business, delivering the changes required will inevitably mean taking on vested interests.

Freeze prices and cut profits for domestic European producers

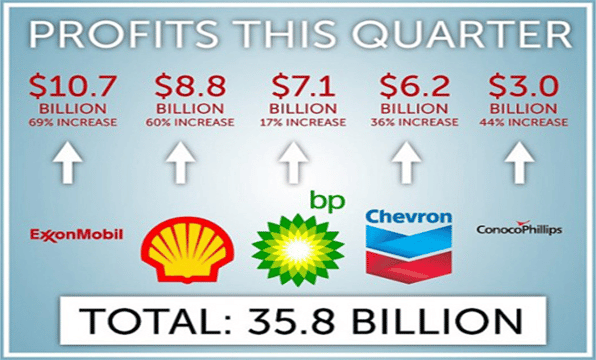

Pre-tax profits for the first six months of 2022 at Harbour Energy soared to almost $1.5 billion (£1.3bn), up from $120 million a year earlier. Profits were up by a factor of 12.5 times. This is down to the global increase in wholesale gas prices, nothing that Harbour has done to improve their business.

For the UK, 50 percent of gas use comes from North Sea producers. Cut prices back to where they were before the recent hikes in global prices and you eradicate half of the problem. The same process could be emulated across Europe with UK and Norwegian producers being told to keep prices low. They will still make good profits and their shareholders can afford to take a mild hit; and the latter’s portfolios would also be protected from the catastrophic meltdown of European industry that’s likely to occur due to ridiculous increases in energy input costs.

Regarding the argument that this would damage investment in the industry: (i) as said above this remains a profitable industry; (ii) the reality is that many of the big players are not investing as it is, but instead using increased profits as a chance to reward shareholders and engage in predatory takeovers:

“The company, which is listed on the FTSE 250, said it would generate up to $1.7bn in spare cash this year, paving the way for more acquisitions and larger dividends … It has asked shareholders to allow it to buy back 15 percent of its shares and says it may pay off its debt this year.”

End blatant profiteering in key sectors

The increase in ‘refining spread’ added 24p a litre to fuel over the last year according to the Competition and Markets Authority. That’s the profit margin taken by refiners – nothing to do with increased costs, straightforward profiteering.

The knock-on effects throughout the economy of increased petrol, gas and electricity prices are serious, and wholly avoidable. Tax cuts/pay-outs to some people do nothing to curtail the impact of increasing energy prices on consumers, and small businesses throughout the economy: genuine action needs to be taken.

The above plans need to be combined with various targeted short-term schemes to help those most in need. Plans such as that of the UK recently announced by Truss’s government, that basically hand a couple of hundred billion pounds of government money to energy companies to subsidise households and businesses, are expensive, inadequate and inequitable.

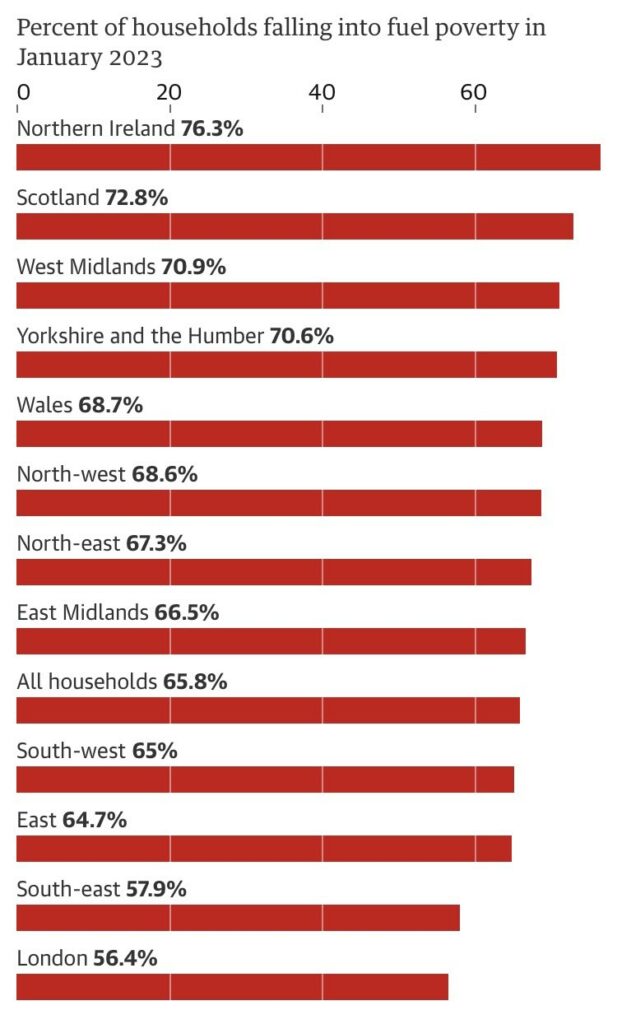

We talked above about the continuing problems experienced by industry across Europe. For consumers, given that it pegs everyone’s energy bills at the April 2022 level – already unaffordable for many – the Truss universal subsidy will leave 6.5 million in fuel poverty and a mounting debt exacerbated by interest rate increases that do nothing to curtail the roots of our inflationary problems. Even at April prices, Citizens Advice warned that they were seeing record levels of people simply unable to afford to use any power at all.

The Institute for Fiscal Studies has said that “the majority of the Truss money will go to better off people who use more energy so this is very poorly targeted”. That’s because the richest households currently use twice as much energy on average as the poorest. Fuel Poverty Action said the plan’s benefits “will largely accrue to people who can afford to use a lot of energy, while people who are barely putting the heating on will save very little.

Whilst the EU appears to be taking a more aggressive stance re windfall taxes than the British, the basic principles of the sacrosanct nature of market prices and the right of energy companies to record massive profits would appear to be being observed. 2019 research showed that over the previous nine years, just five oil and gas corporations and their fossil fuel lobby groups had spent at least a quarter of a billion euros buying influence at the heart of European decision-making. If you want to effect real change, you will have to take on this lobby.

Towards systemic change

In the long-term, profound structural change is necessary and a transformation in the priorities of the overall energy industry if we are to transition to a sustainable economy. We will also need an industry that is not dominated by short-term predatory profiteering of major conglomerates that enjoy excessive influence over governments.

Fossil fuel subsidies remain huge and a significant barrier to the transition to a sustainable economy. An October 2021 IMF report found that the fossil fuel industry benefits from subsidies of $11m every minute:

“The IMF report is a sobering reading, pointing to one of the major defects of the global economy,” said Maria Pastukhova, at the thinktank e3g. “The IEA’s net-zero roadmap projects that $5tn is necessary by 2030 to put the world on the pathway to a climate-safe world. It is maddening to realise the much-needed change could start happening now, if not for governments’ entanglement with the fossil fuels industry in so many major economies.”

Recent communications, unveiled as part of a congressional hearing held in Washington DC into the role of fossil fuels in driving the climate crisis, showed the mendacity of the oil giants ExxonMobil, Chevron, Shell and BP regarding their green policies:

The new documents are the “latest evidence that oil giants keep lying about their commitments to help solve the climate crisis and should never be trusted by policymakers”, said Richard Wiles, president of the Center for Climate Integrity.

“If there is one thing consistent about the oil and gas majors’ position on climate, it’s their utter inability to tell the truth,” Wiles added.

Ro Khanna, co-chair of the committee, said the new documents are “explosive” and show a “culture of intense disrespect” to climate activists. “The oil giants’ climate pledges rely on unproven technology, accounting gimmicks and misleading language to hide the reality,” he added. “Big oil executives are laughing at the people trying to protect our planet while they knowingly work to destroy it.”

Previous releases of internal documents showed that the oil industry knew of the devastating impact of climate change but chose instead to downplay and deny these findings publicly in order to maintain their highly profitable business model. Do we really want these people to direct the massive changes necessary to effect a sustainable future?

With oil and gas continuing to be extremely profitable, it is highly unlikely that the market, ruled as it is by powerful, connected conglomerates that are targeted primarily by their shareholders to make them money, will lead efforts to take the world towards a more sustainable future. From a financial point view, the world’s 60 largest lenders provided only slightly less financing for fossil fuels in 2021 than the $750bn recorded in 2020, according to a report by the Rainforest Action Group. The banks have provided a total of $4.6tn since the Paris Agreement was signed in 2016, peaking in 2019 at $830bn.

In May 2022, the world’s second-largest asset manager Vanguard refused to stop new investments in fossil fuel projects and end its support for coal, oil and gas production. The CEO said: “Our duty is to maximise long-term total returns for clients. Climate change is a material risk but it is only one factor in an investment decision.”

National and European Energy Plans needs to be drawn up and agreed as a matter of urgency, this is too important an issue to be left to companies, banks and investors whose focus is on the short-term maximisation of shareholder value. These plans should focus on:

- Energy priorities given the constraints of sustainability;

- The investment required to achieve those priorities and how it can be funded;

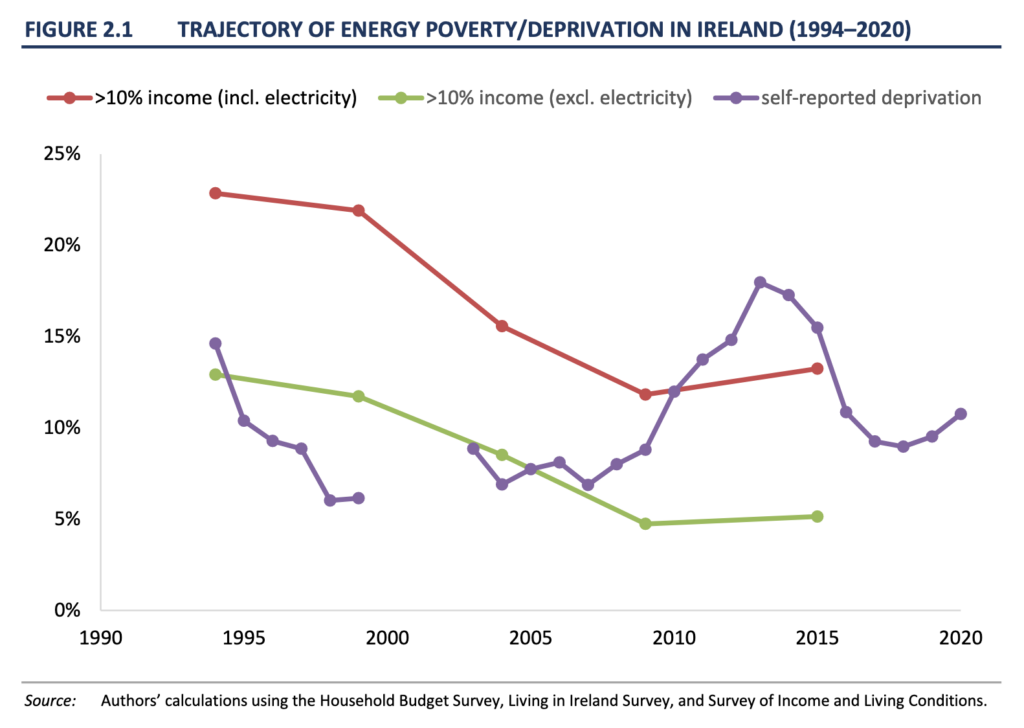

- The eradication of fuel poverty;

- The long-term model for fuel provision and the technologies involved; and

- The initiation of a transformative investment in the insulation and heating of housing and buildings, which would provide much-needed employment opportunities all across the continent, prevent hundreds of thousands of deaths, and help avert the impacts of the climate crisis by dramatically reducing carbon emissions.

All this needs to be part of an overarching economic strategy that integrates the need for modal shifts in transport from road to rail and other essential and interdependent objectives and strategies. Internationally, there needs to be cooperation and integration with the plans and social priorities of countries like India and China, and how they can move away from business models based on the use of cheap coal without their development and security being compromised.

Will all this require a huge change in the way we organise our economic activity? And a transformation in the values and priorities that direct that activity? Yes, but the stakes could not be higher: Socialism or Extinction.

Comments